- Consumption of streaming maintains last years’ growing trend and represent 88.8 % and total market.

- The physical market closes the semester with a slight rise of 0.03% achieved thanks to the continuous growth of vinyl sales (11.9% regarding H1 2023), which accounts for 62.8% of physical sales revenues

PROMUSICAE releases today sales figures referred to H1 2024

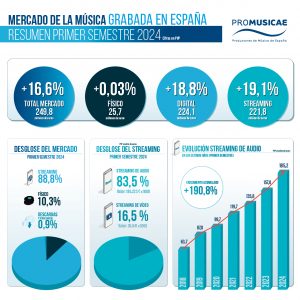

[05th September 2024].- Recording industry takes its usual stock of first half of the year and PROMUSICAE, the organisation gathering more than 95% of the Spanish recording market, is presenting today the figures of H1 2024. The good progress of the Spanish recording market that from January to June 2024 yields a figure of 249.8 million euros devoted to consumption of recorded music in Spain in their different formats. These figures represent an increase of 16.6% compared to the same period of 2023 (214.3 million euros income).

The first six months of 2024 have meant a new growth for the recording industry, mainly thanks to the growth of the digital market, which continues its great evolution with a rise of 18.8 % mostly due to streaming, representing 99% of digital consumption.

The physical market during the first half of 2024 “equals” the growth of the same period of 2023, and remains with a growth of 0.03%, provided mainly by the consumption of vinyl, rising 11.9% regarding the same period of the previous year, whereas CD decrease by 15%. Other formats also decrease compared with the same period of 2023 (down 32.9%) and DVD (down 15.1%).

Streaming is driving the recorded music consumption

Data yielded by the balance of half year 2024 streamline that the good progress of the recorded music market is supported by digital consumption, representing already 89.7% of the total industry with 224.15 million euros. In this digital market, people are mainly consuming streamed music, 88.8% of total market and generating revenues of 221.86 million euros (an increase of 19.1% compared to the same period of 2023). From the above, the provision of audio streaming is to be highlighted, 83.5% with revenues of 185.22 million euros, compared to 36.64 million euros of video streaming (16.5% of total streaming). Streaming revenues could be highly increased if the very relevant percentage of add supported access in our country (68% of total, as gathered by PROMUSICAE’s report published in July “Radiography of Recorded Music 2023”) became, even partly, premium subscriptions; that would get us closer to the levels of neighbour countries, where the main share of consumption is made through subscription services from long time ago.

Regarding the rest of the digital market, permanent downloads keep decreasing (-13%, scarcely providing 1.3 million euros), although it is striking the growth of products for mobile phones that, even not reaching one million euros, register a percentage 7.5% higher regarding last year.

Vinyl holds the physical market

The increase of sales of vinyl on first semester 2024 (11.9% more that the the same period of 2023), providing 16.18 million euros, and representing 62.8% of physical formats sales, makes that the consumption of analogical formats does not yield negative figures overall. Sales of CD drop 15% in respect of first half of 2023, with revenues of 9.39 million euros to the total market.

Promising prospects for recorded music in 2024

Antonio Guisasola, president of PROMUSICAE, is pleased with figures of first half 2024 and notes that “it is very encouraging that in this first part of the year the figures growth of recorded music in Spain keep over 16%, as this highlights that the efforts and talent of Spanish artists and recording companies bear fruit, and music continues grabbing the interest of the public”.

He says that “streaming is obviously the main way in which we consume recorded music and the greatest economic support of recording market, but the public is still demanding physical products such as vinyl, which sales steadily grow and is most valued by consumers”.

For Guisasola, “the challenge remains to push even stronger the Spanish recording production, helping companies of our country to invest in national talent, for which it is essential to be supported with public measures as can be tax incentives to Spanish production and the support to internationalisation of our recording production”. Besides, he adds, “it remains a great challenge for the industry to get the public to make a decided commitment to consume music through payment subscriptions, as it happens in our surrounding advanced countries, that besides notably improving consumption experience, allows the industry to get the necessary economic return to keep betting for our artists’ talent on a sustainable basis”.

Summary of most relevant data

Media Kit and assets following this link

For more information or interviews:

Phone: +34 91 417 0470